Credit index futures poised for growth after volume surge – Eurex

19th February, 2026|Radi Khasawneh

An increase in client adoption and trading volume puts the market in futures based on bond indexes in position to harness increased demand for credit protection, according to a Eurex executive.

Speaking to FOW ahead of the Eurex derivatives forum event in Frankfurt next week, the firm’s global product lead for credit derivatives said the development of liquidity has been spurred by increased use of the contracts by buy side firms in Europe.

“One key development has been the integration of Credit Index Futures on some of the most popular portfolio and risk management analytics platforms,” Davide Masi said in an interview. “As a result, if we observe the open interest development in 2025, one can notice a sharp increase at the beginning of the third quarter, showing the extent of the pent-up demand that existed for the product, driven by buy-side clients.”

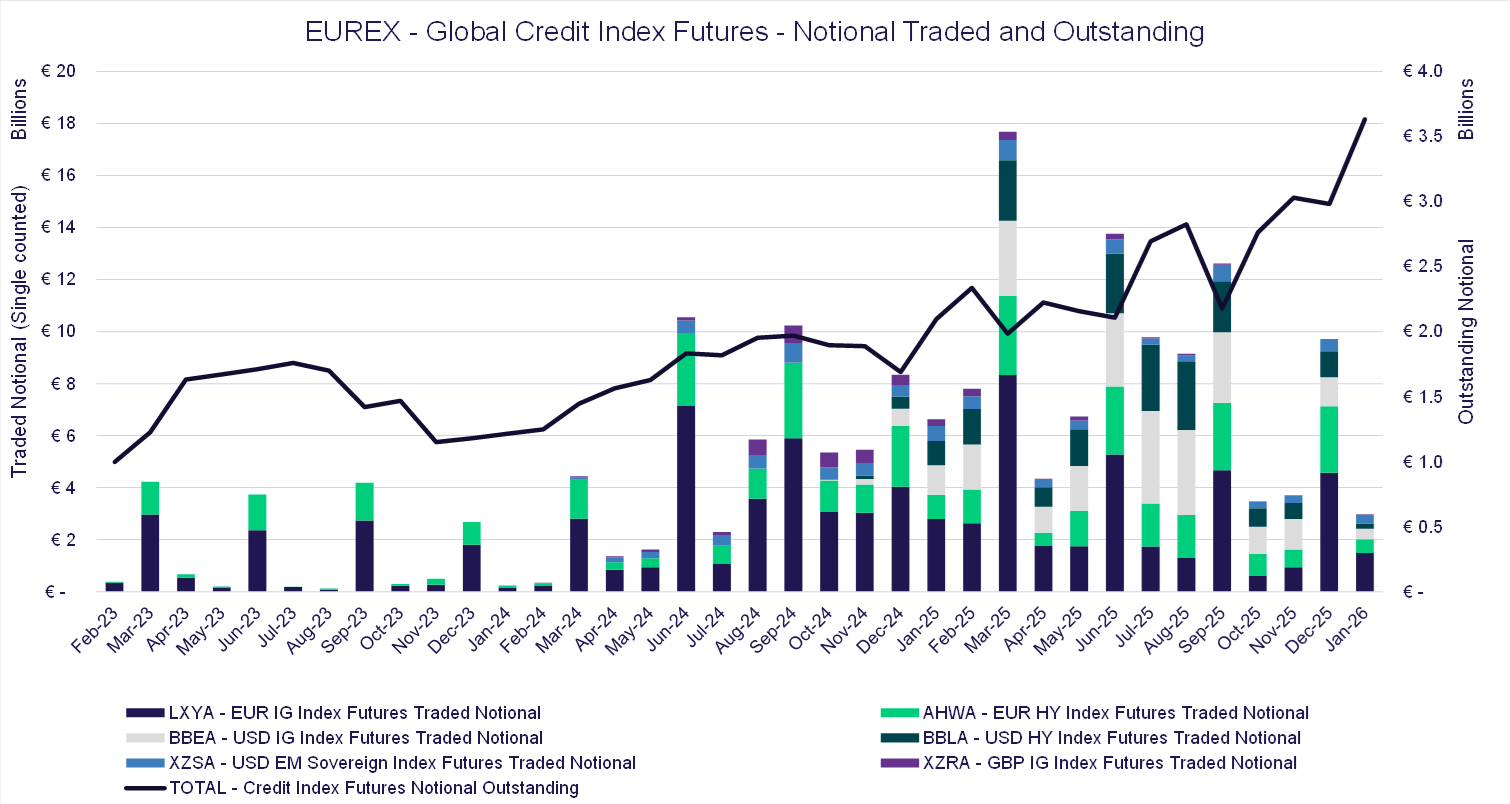

Last year saw the breaching of key milestones for the segment, first launched on the Frankfurt exchange four years ago, as credit risk becomes an important tool in managing market uncertainty. Traded notional across the complex doubled year-on-year in 2025, rising to €111 billion (£97bn) according to figures provided by the exchange (see chart 1). Open interest also breached €3 billion for the first time in the period, an increase of 80% in the period. That increase has in part been driven by the support of sell side market makers, according to Masi.

“A second important aspect is the increased participation and support from dealer banks and liquidity providers in the off-book market,” he added. “In 2025, liquidity in our products further improved thanks to the readiness of new dealers to participate in this market. This improvement had the effect of enhancing the pricing picture offered to buy-side clients in Credit Index Futures, further driving adoption.”

Eurex launched its first US dollar credit futures in September 2024, adding to the European credit futures made available in September 2021. The firm also has pound sterling and emerging market sovereign futures based on Bloomberg Index Services benchmarks.

Chart 1

Source: Eurex

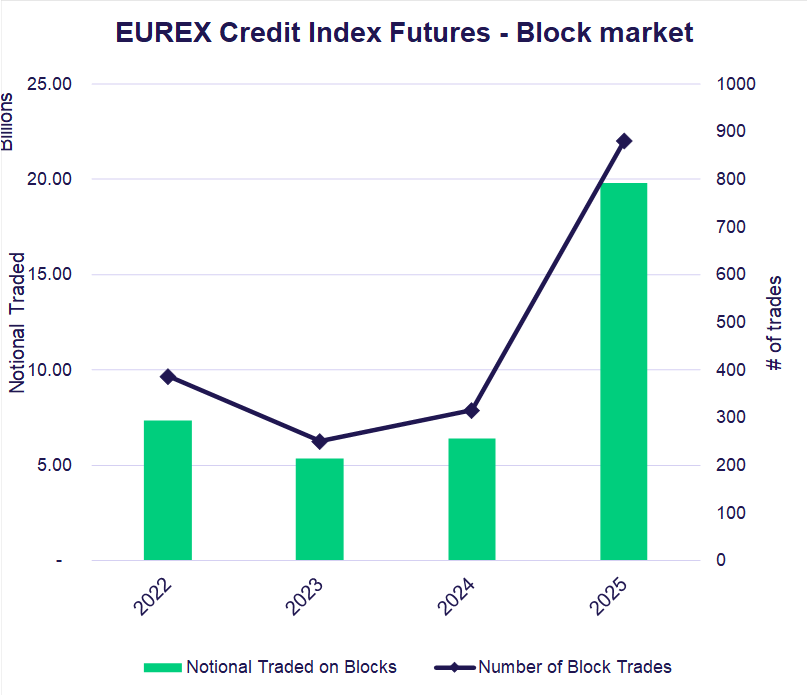

There has also been a steep increase in the number of block trades (see chart 2). The most liquid euro-denominated futures have been key beneficiaries, with more than half of 2025 volume in Euro IG index futures trading through blocks, and 42% of the high yield variant trading through channel. The US dollar denominated EM Sovereign index saw 55% of volume coming through blocks. Part of that was caused by event-driven factors last year.

“Unlike in 2024, 2025 was characterized by more frequent bouts of volatility,” Masi said. “Alongside deeper off-book liquidity, credit index futures showed improved liquidity in the order book as well, which provided a reliable price anchor for buy-side clients.”

Chart 2

Source: Eurex

The next step for Eurex will be to develop liquidity in newer contracts, creating a global liquidity pool for clients across regions.

“In the euro-denominated space, we are coming off years of education, roadshows, and client interactions that helped raise awareness and drive adoption,” Masi said. “The next step is to replicate this success in our existing US dollar suite.”

The Frankfurt-based exchange in August launched a partner program for credit derivatives - an extension of the group's revenue-sharing programs for short-term interest rate (STIR) futures and interest rate swaps rolled out in 2023. The move is designed to encourage liquidity to support an effort to widen adoption for buy side firms.

“There has been a diversification of use cases as well,” Masi said. “We have always had a strong presence from institutional investors within our markets, whereby real-money asset managers would take either long or short exposure to the product for specific purposes.

“In 2025, we saw an increase in usage by fast-money buy-side clients, particularly hedge funds. These firms viewed the contract as liquid enough to enact relative value trades. One example of this is spread trades between EUR credit index futures, seeking to exploit the compression or decompression between high-yield and investment-grade credit spreads in the fourth quarter of 2025.”