Comprehensive Contract Specifications Data

Standardised, comprehensive contract specifications covering more than 120+ exchanges from the industry’s leading provider of quality reference data for exchange-traded and OTC futures and options.

Class-leading Contract Specifications

Detailed, fit-for-purpose contract specification and comprehensive exchange-related data points for global listed derivatives markets.

Trusted Data

Access complete, accurate and compliant reference data for use across the trade lifecycle and your workflows.

Comprehensive Data

Benefit from validated and normalised data that flows seamlessly from our global network of exchanges and partners across your enterprise.

Designed Around You

Work smarter with access to data customised to your required asset classes and exchange coverage.

What Our Contract Specification Can Do For You

Market-leading reference data covering all major exchanges and asset classes, integrated seamlessly across your systems.

Reduce process failures and trade breaks

Reduce the time and cost of collating, normalizing, and maintaining data from multiple sources

Improve your operational efficiency

Expand into new markets with extensive global coverage

Offer an even better service to your clients

Data Delivery In The Format You Need

Our data solutions can be accessed on demand within our data platform or in a range of formats and scales to fit operational requirements.

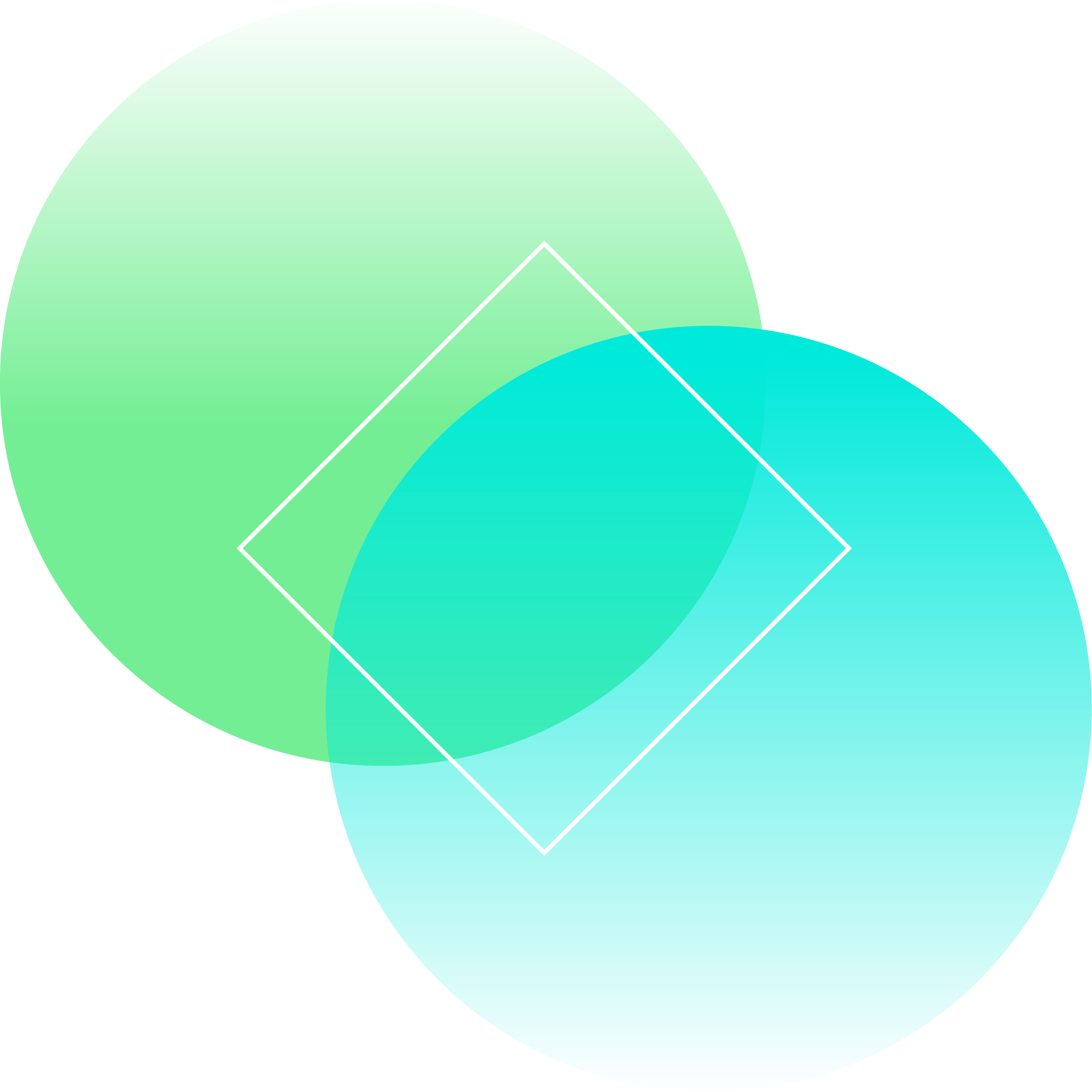

FOW Platform

A single, easy to use platform that puts all of FOW's data at your fingertips.

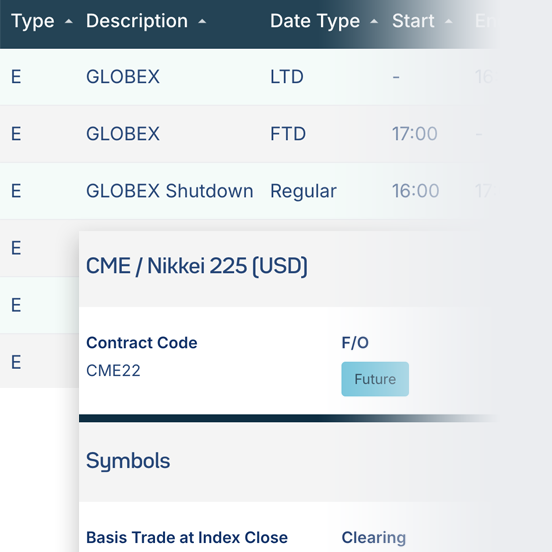

API

Anytime access to machine-readable, high-quality reference data directly into your system.

Data Feeds

Delivered by SFTP, ensuring every function and system across your business uses the same common data.

We use the data to facilitate trading. Without the core data we get from FOW we wouldn’t be able to link anything else to it.

Sell Side T1, VP Business Analyst FO and OTC Clearing

Key Features

Detailed contract specifications

Global position limits

Tick size and value

Exchange information including contract details, trading method, clearing house, regulator and members

Case Studies

Regulated multilateral trading platform needing to respond quickly to changing regulatory reporting obligations

Read Case Study

High quality reference data enhances enterprise data management efficiency for global alternative investment manager

Read Case Study

Leading Global Investment Bank Seeks Single, Golden Source of Normalised and Standardised Reference Data

Read Case Study

Request Data Access

Discover trusted, standardised derivatives data from 120+ global exchanges. Seamlessly access FOW’s comprehensive reference data via API, data feeds, or interactive platform—trusted by industry leaders for accuracy and consistency.

Submit

Related Insights

Gain better insights into the value and quality of our data and how it can support your business needs.

Explore our other data solutions

25+ years sourcing and curating the best quality reference data into solutions to meet all your trading, operations and reporting needs.