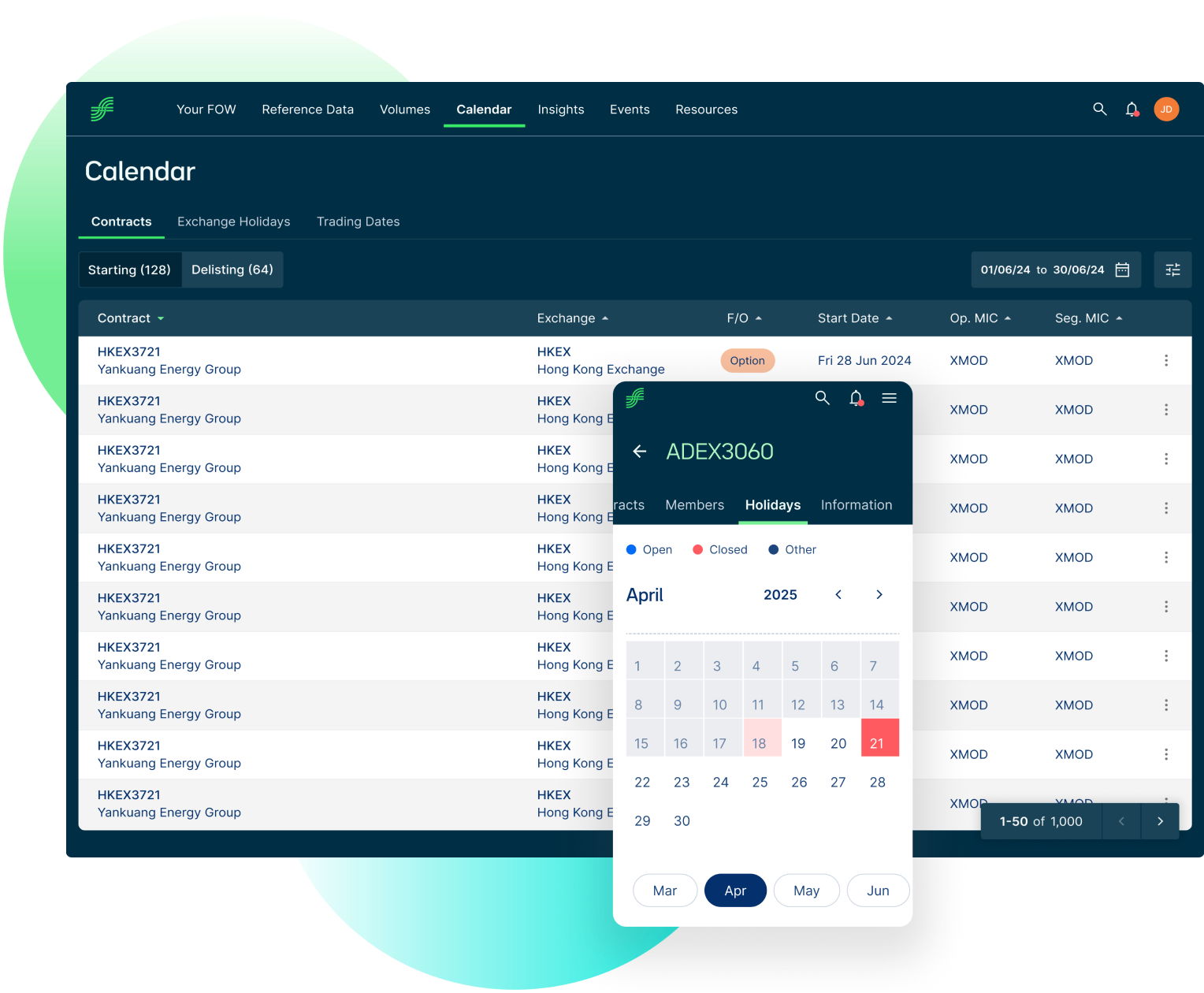

Trading Calendars: Essential Trading Deadline Dates

Trading calendars change consistently and knowing key dates is critical for today’s fast paced and volatile markets. FOW Trading Calendars provide mission critical trading dates to mitigate risk and provide consistency.

Never Miss A Trading Date.

Proactively manage portfolios; reduce failures and trade breaks.

Effective Portfolio Management

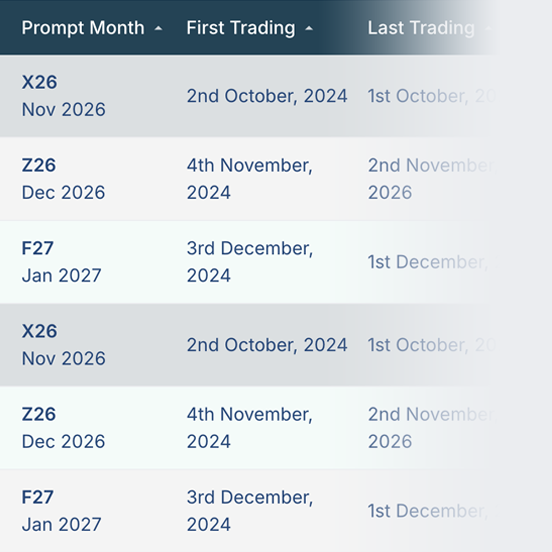

Give your front and back office access to all the trading dates they need to hit every deadline and actively manage client portfolios.

Symbol-mapped Data

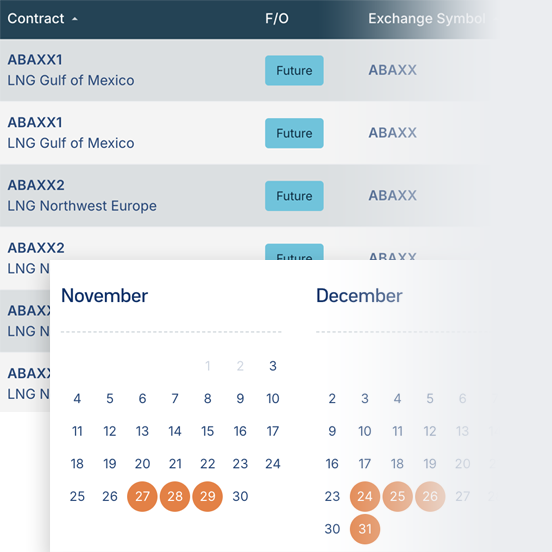

Access fully symbol-mapped trade start and contract last trading dates, instrument session times, and exchange holidays, effortlessly integrated into your propriety and vendor trading systems.

Designed Around You

Use trading calendars reference data files built to suit your asset class and exchange coverage needs.

What Our Trading Calendars Data Can Do For You

Easily integrate mission critical dates across your trading platforms, allowing the middle office to keep on top of trading dates alongside managing client portfolios.

Predict and avoid missed trades

Enhance portfolio risk management

Ensure consistent trading dates across the enterprise

Offer an even better service to your clients

Data Delivery In The Format You Need

Our data solutions can be accessed on demand within our data platform or in a range of formats and scales to fit operational requirements.

FOW Platform

A single, easy to use platform that puts all of FOW's data at your fingertips.

API

Anytime access to machine-readable, high-quality reference data directly into your system.

Data Feeds

Delivered by SFTP, ensuring every function and system across your business uses the same common data.

The data that we obtain from FOW is high quality, which is why we started working with them and still do.

Sell Side T1 - Post Trade Product Management Director

Key Features

Trading dates: Last Trading, First Notice, Exercise, Expiry, Option Maturity, Last Delivery

Exchange holidays

Trading sessions with time zone

Product holidays

Request Data Access

Discover trusted, standardised derivatives data from 120+ global exchanges. Seamlessly access FOW’s comprehensive reference data via API, data feeds, or interactive platform—trusted by industry leaders for accuracy and consistency.

Submit

Related Insights

Gain better insights into the value and quality of our data and how it can support your business needs.

Explore our other data solutions

25+ years sourcing and curating the best quality reference data into solutions to meet all your trading, operations and reporting needs.