ANALYSIS: Commodity exchanges report trading records on stellar first half

9th July, 2025|Radi Khasawneh

Intercontinental Exchange (ICE), CME Group and European Energy Exchange (EEX) have reported six-month trading volume records as traders used their commodity derivatives to hedge volatility caused by the US tariff uncertainty.

ICE, which trades equity, rates, energy and agricultural derivatives, on Wednesday reported an overall record of 1.2 billion futures and options traded in the first half of 2025, overshadowing the 1 billion lots last year. Rivals CME and EEX at the same time set records across global power, energy and gas derivatives markets, also beating last year’s highs.

ICE’s largest segment, energy derivatives, rose a quarter year-on-year to 673.4 million contracts in the first six months of the year, including records in the oil and natural gas market. The exchange’s Brent derivatives also rose a quarter to a new high of 211.4 million lots, while its benchmark Dutch TTF contract stood at a record 61.2 million lots, up a third on the first six months of 2024.

ICE’s Gasoil complex hit 53.5 million contracts, beating the record 48.2 million in the first six months of 2020, according to the exchange.

“In these market conditions, customers favour liquidity and the record first half for volumes traded has been accompanied by record open interest in June as customers utilise the liquidity across ICE’s markets to manage risk exposure across asset classes,” Trabue Bland (pictured), senior vice president in charge of futures exchanges at ICE, said in a release.

“As our customers seek price transparency for every point of their exposure, we thank each of our customers for their continued trust in our markets.”

The Atlanta-based exchange also saw a 32% increase in rates trading to 461.9 million lots in the first half which included a high of 283 million lots of Euribor futures and options.

CME Group has also reported a record first half, driven partly by the US group's commodity markets. The US group's commodities average daily volume (ADV) in the first six months was 5.8 million lots, comfortably beating the previous record first half ADV of 4.9 million lots in 2018, according to FOW Data.

CME's first half included ADV highs in the group's energy futures and options market of 3 million lots while the group's agricultural segment hit an ADV record of 1.96 million lots and the metals market reached an ADV of 838,000 lots.

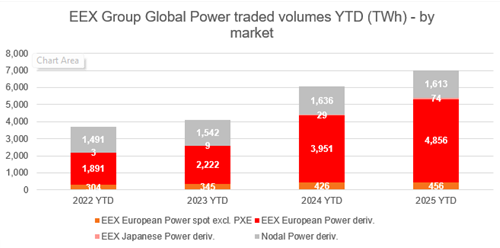

At EEX, power markets trading rose 16% year-on-year across both derivative and spot markets, to just under 7,000 terawatt-hours (TWh), according to the exchange (see chart 1). European power derivatives, the largest EEX market, rose 23% on last year’s record to 4,856 TWh while the growing Japanese power derivatives segment has already overtaken the 2024 full year total at 73.6 TWh.

Chart 1

Source: EEX

EEX's European natural gas derivatives rose by a quarter in the period, to 2,607 TWh in the first half of 2025, including a 28% rise in Dutch TTF volume to 1,675 TWh.

The North American natural gas futures market hit 173,694,431 megawatt hours (MWh) in the first half of this year, 56% higher than the first six months of 2024, according to the exchange.

“2025 so far has seen further strong growth in terms of volumes on our global power and natural gas markets, continuing the trend of the previous years,” Peter Reitz, chief executive of EEX, said in a statement. “It’s promising to see such strong trading levels on our markets and we are confident that this can continue until the end of the year and beyond.”

“This extension of our product portfolio is a perfect reflection of our cross-commodity approach when it comes to supporting the trading community at perfecting their trading strategies,” Reitz said at the time.