ICE hit UK rates trading record around last week's budget

4th November, 2024|Radi Khasawneh

Intercontinental Exchange (ICE) said the group's UK short-term interest rate future hit a volume record last week as traders responded to the new British government's first budget.

ICE Futures Europe traded 2.8 million lots of Sterling Overnight Index Average (SONIA) futures and options contracts on Thursday, beating the previous record of 2.3 million contracts on Wednesday, the day of the UK budget.

“The SONIA story has been fantastic, and is testament to a recovery in liquidity and open interest (OI) across the UK rates franchise since 2022,” Caterina Caramaschi, vice president and head of financial derivatives at ICE said. “Following a tough period after the mini budget, we have seen liquidity and OI improve with year-to-date volumes in SONIA futures and options as of end October, surpassing the record yearly volume of Short Sterling Futures and options back in 2018.”

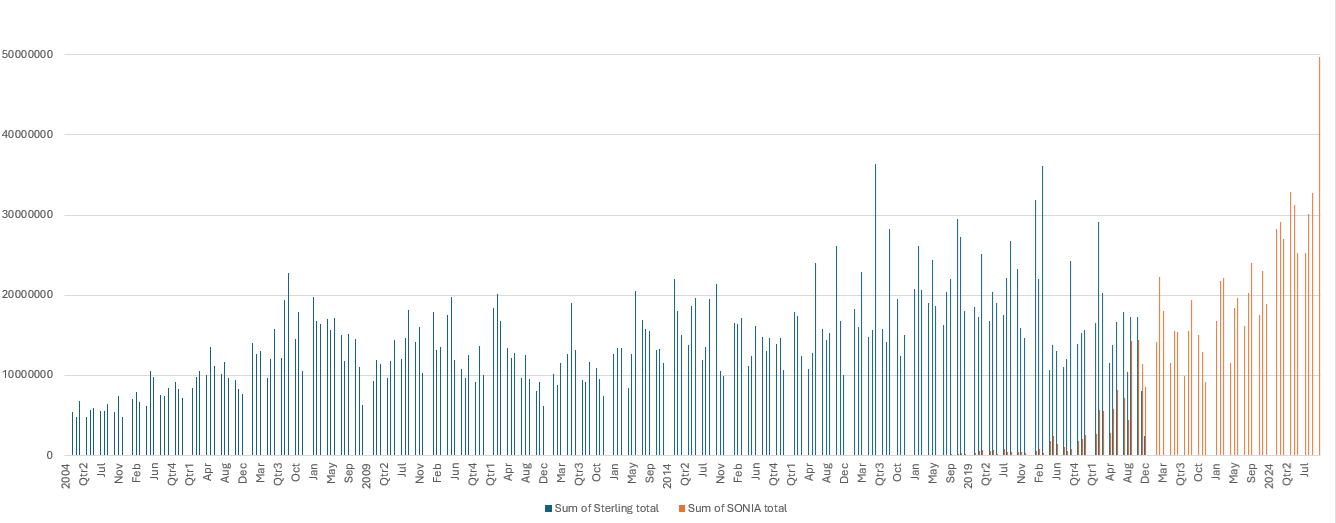

With the latest activity, ICE’s SONIA franchise has surpassed the best ever full year for its Libor-based short sterling contracts which was 263,314,008 lots traded in 2018. SONIA in the first ten months of this year saw 149 million contracts trading, which equates to 298 million lots based on differences with volume reporting between the contracts (see graph 1).

Graph 1

ICE Short Sterling versus SONIA futures and options - monthly volumes

Source: ICE, SONIA contracts recalculated to reflect double counting in historical short sterling

Gilt yields – which move inversely to the price of government bonds – gapped up last week reflecting bearish sentiment. The 10 year gilt saw a 21 basis point increase in yield between October 25 and October 31, according to Bloomberg data, reaching a 12 month high. Gilt markets stabilised on Monday as traders look to Thursday’s Bank of England rates decision and the US election on Tuesday.

Open interest in ICE’s Long Gilt derivatives hit 857,478 lots at the end of last week after setting a non-roll month single day trading volume record of 594,000 lots on Thursday, according to figures provided by the exchange.

Gilt options in October also saw over 76,000 contracts traded, and an open interest high of 50,000 lots on October 24.

“The stability of our rates franchise across SONIA, SARON and Euribor, and more recently ESTR, has been reflected in these recent records, and shows the maturity of our cross currency offering as the hedging market of choice in the face of continued uncertainty and monetary policy shifts,” Caramaschi added.

Exchanges have had a strong year in interest rates as continued uncertainty has fuelled trading activity. ICE last month had a record average daily volume (ADV) of 3.7 million contracts, a second consecutive record month for the segment. Within that total, SONIA derivatives saw more than 1 million lots trading a day on average in October, surpassing the 783,810 lot ADV record set in April 2024. ICE Euribor also broke 50 million contracts for the first month ever, surpassing the record set in March 2020.