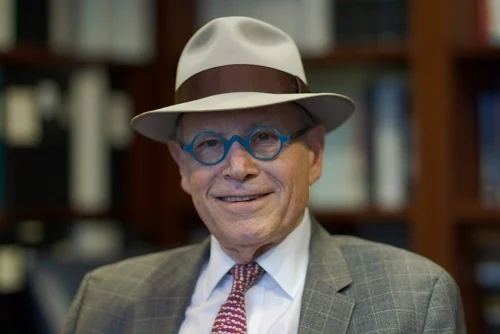

Dr Richard Sandor discusses the sentimental launch of Ameribor futures with FOW

Financial futures pioneer Dr Richard Sandor said it was a “complete accident” that the birth of Ameribor coincided with the end of Libor as he eyes the next phases of the ten-year road to adoption.

Ameribor – the American Interbank Offered Rate – was established in 2011 to provide a benchmark based on real transactions that would reflect true funding costs of small and regional banks in the US.

The decade-long timeframe for adoption just happened to coincide with when Libor started to fall away.

“We started in 2011 and said it is always going to take ten years and it was a complete accident that it coincided with the end of Libor. Once in a while you get lucky,” Sandor told FOW.

“When we first established the rate, people said you are too early, interest rates are zero, and Libor is going to live forever.

“The answer is if you want to be on time, you have to be early.”

Ameribor was introduced on the American Financial Exchange (AFX), also founded and chaired by Sandor in collaboration with Chicago-based exchange Cboe, four years later.

The intention was not to create a new rate, but to have the rate come from real, verifiable transactions by members themselves. Having started out with four banks it now has about 20% of the US market by assets and by numbers.

The natural next step in the journey is to launch the futures – a somewhat sentimental moment for the man who himself is known as the "father of financial futures".

“The futures will launch August 16 for sentimental reasons as it’s the birthday of Treasury bond futures,” he said.

Sandor pioneered the first interest rate futures contract back in the 1970s and then what became one of the most widely traded contracts, Treasury bond futures.

Ameribor futures will cater to a specific market – small, regional and mid-sized banks and corporations – with a need for something that has basis risk, and that represents their borrowing costs.

The plan is to go-live with one-week futures and 90-day futures on the Cboe Futures Exchange.

The reason for the one-week future is that the Fed estimates minimum reserve requirements every other week, so this will be a real hedge vehicle.

“Banks will be able to hedge the floating to fixed and we will work on the development of a swaps market to match the futures over the next year,” Sandor said.

In the new multiple rate environment, Ameribor is set to be a “perfect complement” to the Secured Overnight Financing Rate (SOFR), because the latter is a risk-free-rate used by institutions, while Ameribor is a risk-on rate aimed at a different market.

“I have been in this business for more than 40 years and I know of no asset class that has a single benchmark so why should we not think that there will be multiple interest rate benchmarks.

“Libor was an accident, it was never meant to be so widely used. So as Libor loses its pre-eminence it allows for the birth of a family of interest rate benchmarks, and that is comparable to what exists in other asset classes.

“It also has the side benefit of reducing systemic risk,” Sandor added.