2025 Review: ICE looks to EM launches, retail to buoy equity growth

23rd January, 2026|Radi Khasawneh

Intercontinental Exchange (ICE) has pointed to growth potential in its index suite after a year where European markets were affected by subdued equity derivative volumes.

Speaking to FOW on trends from last year, ICE’s vice president of financial derivatives said diversification-led flows had been strong across MSCI equity index futures – driven by global coverage across more than 100 contracts. Volatility related to geopolitical events, particularly the rollout of a tariff regime by the US administration in April boosted volumes in asset classes such as rates, but the story in regional equity derivatives markets has been more nuanced.

“Despite the tariff-related volatility spikes seen in early 2025, volumes in equity derivatives have been subdued across the board, especially in Europe,” Caterina Caramaschi (pictured) said in an interview. “It does seem that markets are more resilient to headlines, or that there is certainly more risk appetite in reaction to events. One positive we have seen in our markets is our MSCI Futures franchise.

“We are lucky to have a very diversified portfolio, not just in equities but also in rates, and the fact that we have products on the MSCI Emerging Market Index and MSCI Europe, Australasia and the Far East (EAFE) Index means we can capture global trends covering both Emerging and Developed markets and that is shown by our growth in average daily volume (ADV) in derivatives based on those two indexes.”

ADV in MSCI futures and options at ICE rose 4% year-on-year, to 215,000 lots a day on average in 2025 according to data published by the exchange. Open interest in the contracts rose 3% in the period to 1.765 million lots, partly driven by a technology-led rally in the Asia Pacific region. ICE is preparing a further expansion of coverage in the area, through an extension of its existing partnership with FTSE according to Caramaschi.

“In terms of Emerging Markets, the potential growth story has been fuelled by the strength of Chinese, Korean and Taiwanese markets – driven by the strength of some sectors like semiconductors and AI,” she added. “We are expecting to launch Futures on the FTSE Korea Index, so that it sits alongside our large pool of MSCI Emerging Market futures open interest.

“The FTSE Korea is a capped index, so there is no risk of it being classified as narrow based under Commodity Futures Trading Commission (CFTC) rules – this gives US investors consistent access to the Korean market.”

The Atlanta-headquartered exchange group is also looking to harness the growth of retail trading in the US market with expansions into its core UK and European offerings.

“What is exciting for us is our push into retail,” Caramaschi said. “Historically ICE has been more of an institutional exchange, but now with the growth we have seen in retail markets in the US, and the arrival of the large US retail brokers in the UK, this is something we can’t ignore.

“That is why we launched mini-UK, European and US single stock options and mini–US Single Stock Futures, mini-FTSE 100 futures and mini daily FTSE 100 options.”

The combined ADV of rates and equities at ICE rose 16% last year to 3.8 million contracts in 2025, according to exchange data. That was attended by a 46% increase in open interest to 36.4 million contracts as traders positioned themselves for policy changes throughout the year.

“2025 was a strong year for our Rates franchise with multiple records, thanks to the macro-economic environment but also our liquid multi-currency short-term interest rates (STIRs) offering,” Caramaschi added. “Over the past two years we have made a real effort to get a wider range of market participants to actively engage with the full breadth of our product suites and that has really begun to show in terms of the depth of daily volume and open interest.”

To go alongside its dominant position in Euribor STIRs, ICE competes with two other exchanges in the Libor alternative market. Chicago’s CME Group launched the industry’s first futures contract to reference the euro short-term rate (ESTR) in late 2022 quickly followed by Frankfurt’s Eurex and London’s ICE Futures Europe.

“When we first launched ESTR futures, we took a cautious approach because of our existing Euribor futures and options market,” Caramaschi said. “We wanted to make sure we were developing a product that had real client utility and not fragmenting our Euribor products. What has become clear, in our view, is that both Euribor and ESTR derivatives can now coexist as clients have a need for liquid products in both rates.

“We have invested heavily to grow liquidity in our ESTR futures, and at the end of last year we hit a record of 2.1 million lots of ESTR futures open interest, versus 5.7 million lots of Euribor futures open interest. We are now at the point where our ESTR futures are established and have a place in the market. We have really pushed hard to have good screen liquidity, good customer mix and our top-of-book is by far the most competitive in the space.”

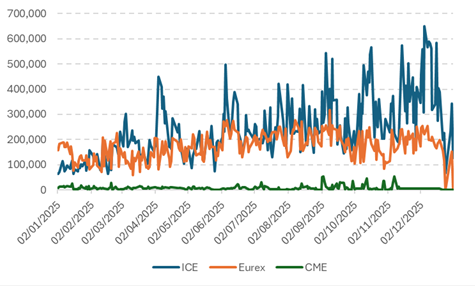

ICE in the second half of last year represented two thirds of both open interest and volume in ESTR derivatives, solidifying its position in the market (see chart 1).

Chart 1

ESTR daily volume (contracts) in 2025 by exchange

Source: Exchange data

The exchange also in February last year launched its first Bank of England Monetary Policy Committee (MPC) dated futures based on the Sterling Overnight Index Average (SONIA) rate. The listing followed the December 2023 listing of European Central Bank (ECB) policy meeting futures.

“We are also seeing increased demand for our Central Bank Dated futures,” she added. “We have MPC SONIA and ECB ESTR Dated futures that are designed so customers can take positions about interest rate hikes/cuts around monetary policy meetings. The key point of difference vs standard STIR futures is that these contracts settle on the meeting dates rather than settling quarterly.”

MPC SONIA open interest peaked at 29,026 contracts at the end of December, according to FOW data. That has since continued to climb and hit a new high of 37,121 contracts on January 19, exchange data shows. The ECB contract peaked at 17,163 lots in open interest on December 22, reflecting more positioning from traditionally over-the-counter (OTC) traders.

“Customers are utilising MPC SONIA and ECB ESTR futures because they replicate OTC products in the Overnight Index Swap market but are listed on exchange and this is reflected in the open interest highs hit during 2025,” Caramaschi said.

The US group, which operates clearing houses in London and Amsterdam, said in December ICE Clear Netherlands will start supporting its three month Euribor futures and three month ESTR futures. The move gives clients the option to shift to a European domiciled clearer to comply with mandatory rules that came into force in June last year.

“We went live at the beginning of December,” Caramaschi said of the Netherlands launch. “Obviously with any clearing house there is a lot of work going on in the background to get clearing members signed up so that onboarding effort is ongoing. The key point is that we are giving people who have to clear on a European exchange the optionality to choose between our UK and Netherlands clearing houses.

“This is helping clients to continue to benefit from the liquidity in our rates offering and the feedback from clients has been very good on the use case.”