Symbology Service: Data Standardisation & Normalisation

Class-leading cross-vendor symbol mapping provides seamless client onboarding, regardless of the client’s own market data, order execution and portfolio management systems.

The Perfect Match. Instantly.

Comprehensive and dynamic cross-vendor symbol mapping enabling the seamless transfer of order information across the front, middle and back offices.

Proven Symbol Mapping

Benefit from a system curated and enhanced over 25+ years of working with tier 1 clients and partners.

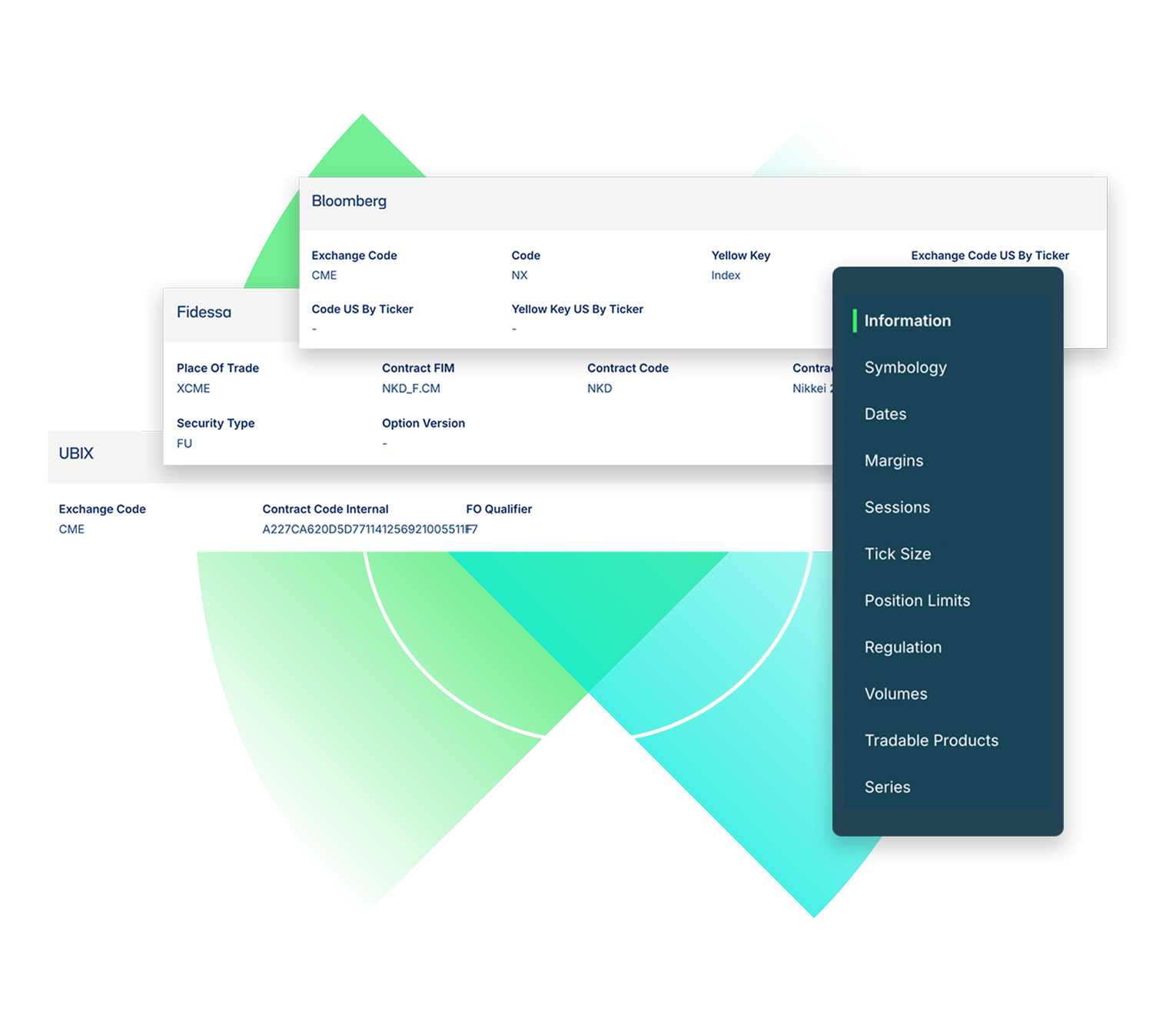

Over 20+ Distinct Symbologies

Leverage instrument data enriched with root or trade series level symbols and mapped to key market data and back-office vendor identifiers.

Multi-vendor System Compatibility

Ensure compatibility with instant order mapping from client platforms into clearing, settlement, portfolio and regulatory reporting systems.

What Our Symbology Service Can Do For You

Cross-vendor symbology mapping data with full sets of identifiers, allows you to seamlessly on-board and manage clients who use differing systems for market data, order execution and trade management.

Reduce your processing costs

Save the time and money it would take to implement and internal mapping system

Improve risk management

Accelerate new business

Raise the quality of your service offering

Data delivery in the format you need

Our data solutions can be accessed on demand within our data platform or in a range of formats and scales to fit operational requirements.

FOW Platform

Our root level symbology data can be accessed through a single, easy to use platform that puts it at your fingertips.

Data Feeds

Delivered by SFTP, ensuring every function and system across your business uses the same common data.

API

Anytime access to machine-readable, high-quality reference data directly into your system.

We use FOW to provide an extra layer of consistency for the important fields so we don't have to go to multiple providers and suffer integration and technical headaches. We don’t need to get a field from hundreds of different places when we can get it all normalised through FOW.

Technology Vendor, Global Head of Data Operations

Key Features

Independent, industry-neutral service

Securing cross-industry, multiparty support which includes attributes such as: CUSIP, GL (Valdi), GMI, UBIX, ION, CQG

Dynamic tracking of open positions by retrieving real-time prices from market data connects

Featured case study

Leading Global Investment Bank Seeks Single, Golden Source of Normalised and Standardised Reference Data

Read Case Study

Request Data Access

Discover trusted, standardised derivatives data from 120+ global exchanges. Seamlessly access FOW’s comprehensive reference data via API, data feeds, or interactive platform—trusted by industry leaders for accuracy and consistency.

Submit

Related Insights

Gain better insights into the value and quality of our data and how it can support your business needs.

Explore our other data solutions