Japan Exchange hits twenty year bond future open interest high

26th August, 2025|Radi Khasawneh

Japan Exchange Group (JPX) has reported an all-time open interest high for its 20 year Japanese government bond future just weeks after reviving the product with an incentive scheme.

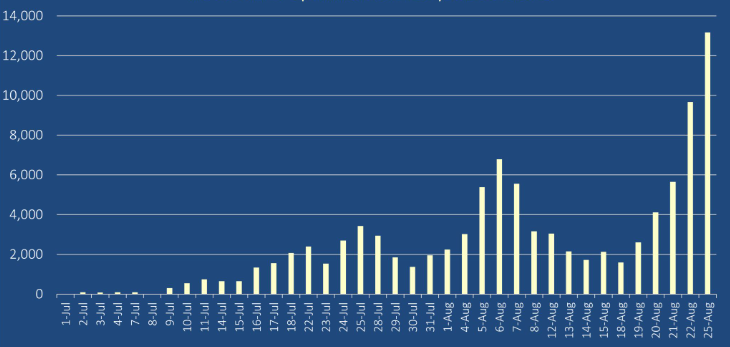

The Japanese Exchange Group said open interest in the 20-year Japanese government bond (JGB) future listed on its Osaka Exchange venue hit a record of 13,000 contracts on Monday (see Chart One).

“20-year JGB futures, a missing link in Japan's rate derivatives, have reached a great milestone since trading was reactivated in July, with open interest surpassing 10,000 lots on August 25, the highest level ever recorded since 1989,” Kensuke Yazu said in a post on Tuesday.

“We are seeing strong attention from both hedge funds and domestic buy-side institutions, perceiving the contract as a valuable addition to the toolkit for trading and hedging in the ultra-long JGB tenors.

“More market participants, as we've received their positive feedback, are expected to enter the market once observing smooth rollover activity in September.”

Chart 1

Source: JPX

JPX, which originally launched the long-term government bond future in April 2014, opened in July a new incentive scheme to support the contract, with July 2 seeing the first trading in the product for three years.

Total volume in the contract in July was 12,099 contracts, according to FOW data, the highest level since 2014.

JPX, which dominates the market for JGB derivatives, competes with Singapore Exchange (SGX) in the 10-year JGB market.

SGX saw 23,327 mini JGB futures trading in July, according to FOW data, 39% lower than the same month last year. Osaka Exchange, meanwhile, saw 630,419 10-year JGB futures changing hands in the month, according to FOW data, down 20% on July 2024.

SGX in July last year listed a short term Tokyo Overnight Average Rate (TONA) future, pitching it into competition with the Osaka Exchange and Tokyo Financial Exchange (TFX). OSE’s TONA volume rose 24% year-on-year to 191,440 lots in July, according to FOW data. That compared to a 6% increase at TFX in the period, to 133,833 contracts, and 36,197 lots on SGX.