ANALYSIS: Margin, cost pressures leading commodity traders to options – FIA

6th August, 2025|Radi Khasawneh

Higher margins and cost pressures are leading commodity end-users to trade more options, a senior figure at the industry trade body has suggested.

Speaking on a webinar to present quarterly volume trends last week, the Washington-based trade association’s global head of market intelligence said rising volatility has increased margin requirements for commodity futures users, driving them to relatively cheaper options positions.

“We have been seeing higher and more volatile margin requirements over the last several years because of a) the pandemic in 2020 and b) the extreme weather volatility in certain parts of the US – most notably winter storm Uri in 2021 and c) Russia’s invasion of Ukraine in 2022,” Will Acworth said. “So again, that is higher and more volatile margin requirements that will affect futures end users more than options end users.

“That is because those margin requirements create funding issues for energy producers and other end users that are trying to hedge risk in their production or input costs… If you are only paying the premium on an option – so not futures-style margining but options-style margining– it provides more certainty than futures in terms of the cost of protection.”

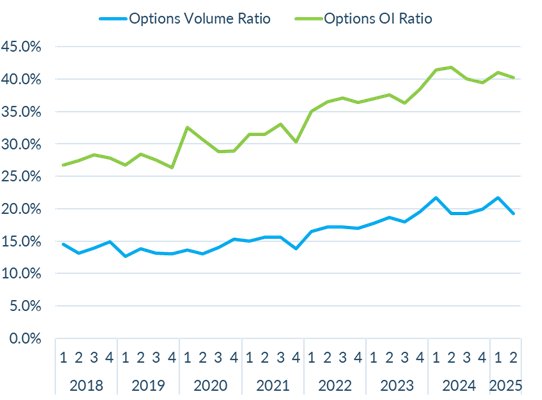

Overall, commodity trading volume in the first six months rose 12% to 6.5 billion contracts, according to FIA data. At the same time open interest increased 13% to 179 million lots. While the markets have been growing, more trading is done through options, particularly in the US markets (see chart 1). The FIA analysis covers energy, metal, agricultural and other contracts traded on US venues, but does not include exchange-traded fund options or contracts traded on securities exchanges.

Chart 1

Ratio of options to overall volume and open interest on US commodity futures exchanges

Source: FIA

“What we have seen is a significant shift in that ratio,” Acworth added. “For example in open interest – which is probably more indicative because that is where people are more focussed on risk management – that ratio has gone from under 30% of the total pie in 2019 to over 40% this year.”

Another reason has been a change in funding by commodity producers and other end-users, which has reduced the structural demand for hedging, according to Acworth.

“Second, and this maybe a smaller but I think it is a significant factor, there have been changes in the financial condition of US oil and gas producers that have led to a reduction in hedging,” he said.

“If you look at the financial reports from the publicly traded oil and gas producers in the US, you can see that there is greater financial discipline and less use of bank financing to leverage their operations. That has been a change in financial discipline that has taken place over five or six years.

“One result is that they are not forced or required to hedge their downside risk by the banks that are lending them this money, so instead the hedging strategy becomes optional. So there is less use of hedging in general, but, when they are hedging, it tends to be with options-based structures such as collars.”

Major global commodity exchanges reported record revenues in the first half of this year, partly driven by record levels of commodity trading.

CME Group booked an all-time revenue high of $1.69 billion (£1.3bn) in the second quarter of 2025 as the exchange group benefitted from market volatility. The exchange's main light sweet crude West Texas Intermediate (WTI) futures saw volume rise 20% in the first six months to 127 million lots, according to FOW Data. Volume in the group's most liquid light sweet crude oil option rose 37% in the period to 22 million contracts.

“In commodities we have seen tremendous growth in our energy options franchise,” Rhodes said at the time. “When I rejoined ICE in 2022, we were at about 32 million lots in open interest for commodity options, and now we have about 50 million on a regular basis… When it comes to uncertain probability distributions, it is those products that act as a more granular hedge.”