ANALYSIS: Cboe tracks evolution of same day options into single names

4th August, 2025|Radi Khasawneh

Cboe Global Markets sees the expansion of zero-day-to-expiry (0DTE) contracts into large single stock names as a further catalyst for growth in its core options business.

Speaking as the Chicago-based exchange group presented record second quarter earnings on Friday, global head of derivatives Catherine Clay (pictured) said efforts to list short-dated expiries for the most liquid US names would complement growth in index options.

“We actually see the single-stock 0DTEs as not cannibalistic to the index option 0DTE - it's more [of an issue] for the exchange-traded fund (ETF) 0DTE space,” Clay said in response to an analyst question. “We really feel that with the difference between single stock options – [with] things like cash-settled, European exercise [or index 0DTE] - really they're completely different animals.

“We see a lot of retail traders coming into the single stocks or the ETF options and then migrating into the index options space as that level of sophistication of that trader continues to grow.”

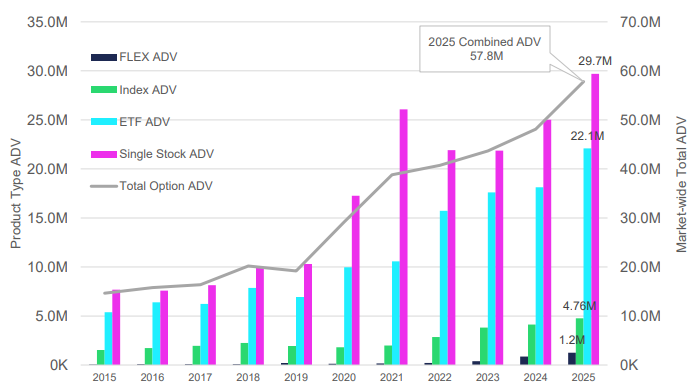

That followed Nasdaq’s application in May to add Monday and Wednesday expiries for large companies, according to a Bloomberg report. The application with the Securities and Exchange Commission (SEC) means the contracts could be listed in the first half of next year. “Multiply listed” single stock options, as in contracts that are listed on many US markets, remain the largest segment, according to analysis of US option volumes by Cboe (see chart 1), making up more than half the market.

Chart 1

Average daily option volume (US market)

Source: Cboe LiveVol, data to end of June 2025

As exchanges look to extend trading hours, and eventually adopt 24 hours a day, seven days a week trading, these trends can feed the overall growth trend of the market, Clay added.

“The industry is kind of digesting what this means in terms of how to do basic things - like how do we process corporate actions, and how do we make sure that the end investors is safe for additional earnings announcement-type activity,” she said. “So there is definitely an appetite to expand into more expiries for single stocks, and we're all for that.

“We believe, again, that when we bring retail traders into products that they want to trade because they like the name or they're interested in the theme, they eventually grow in that journey of sophistication and find their way to index options. So we compete in a multi-list space, and all of these initiatives for the single stocks. We're watching very closely as the industry gets through these conversations about how we do this in a proper way so that we have broad adoption and participation from all the market participants that would need to have access and need to feel safe in this new environment.”

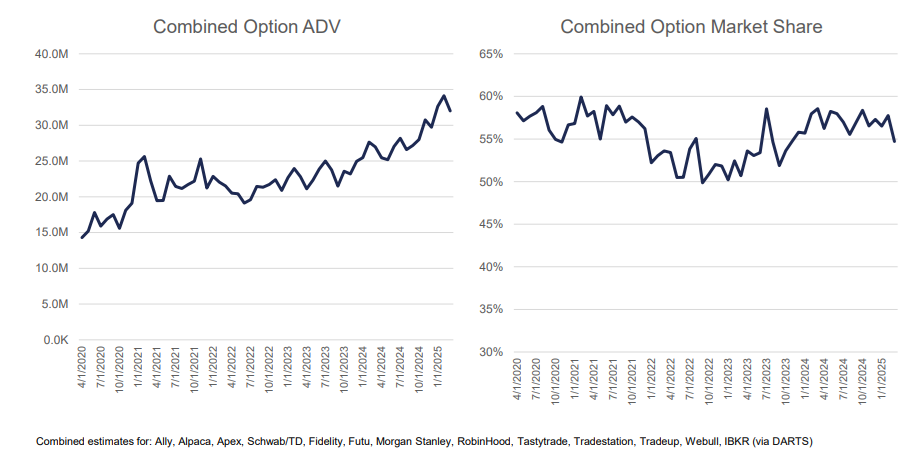

Cboe estimates retail brokers have made up between 55% and 60% of the options market since the beginning of last year (see chart 2), and the exchange is redoubling efforts to expand its partnerships with these firms.

Chart 2

Estimated Retail broker activity (average daily volume (ADV), market share)

Source: Cboe LiveVol, data to March 31

“When we think about our expansion with retail broker-dealers, both in the US and abroad, we feel that there's still a lot of surface area opportunity here,” Clay said. “Retail traders tend to start trading in other products, and then as their sophistication level rises, they move into the index option complex, primarily for the benefits of index options in general; the cash settlement, the European exercise, potential tax treatment benefits.”

Cboe's S&P 500 index (SPX) 0DTE options hit a daily record of 2.2 million contracts in June, according to data from the firm. The same day options hit a record 57% of overall SPX volume in the second quarter, the data shows. SPX volume in the second quarter was 10.8 million lots in ADV, a second consecutive record quarter, according to FOW Data.