ANALYSIS: Cboe looks to buoy FLEX market with complex order rollout

26th June, 2025|Radi Khasawneh

Cboe Global Markets is rolling out new services to allow the US group's options trading clients to deploy more complex strategies, the firm has said.

Cboe this week started supporting complex FLEX vs. listed complex orders, allowing multiple legs of a trade involving FLEX options and the listed equivalent to be booked as one trade. Cboe first launched FLEX instruments in 1993, allowing options traders to adjust expiration, strikes or exercise style on the exchange's standard single stock and index contracts.

The move to support FLEX vs. listed complex orders, which Cboe suggested is the first of its kind for this market, complements other recent deliveries of electronic automated improvement mechanism auction functionality and theoretical pricing.

“We spend a lot of time talking to members and participants, and the introduction of Complex FLEX orders was part of that process – to help them optimise trading and increase operational efficiency,” Meaghan Dugan (pictured), head of US options at Cboe, said in an interview. “During volatile market environments, investors are looking for ways to manage risk with greater flexibility and precision.

“As the growth of FLEX options has significantly increased over the last several years, there was a growing need for an innovative way to simplify the order management process for those users.”

Cboe has been benefitted from an explosion in trading activity due to recent market volatility. The exchange earlier this month reported 1.8 billion lots trading in the first five months of this year. At the current run rate of around 367 million contracts a month, the firm could in 2025 break 4 billion lots in one year for the first time.

The exchange in May saw single stock options activity of 12.7 million contracts in average daily volume (ADV), a rise of 28% on May last year.

The exchange’s index options ADV rose 15% on the same basis to 4.3 million contracts. Cboe traded 72.7 million S&P 500 index option contracts last month, according to the OCC. That was 18% higher than the same month last year but behind March and April this year, which both had more than 80 million lots, according to FOW data.

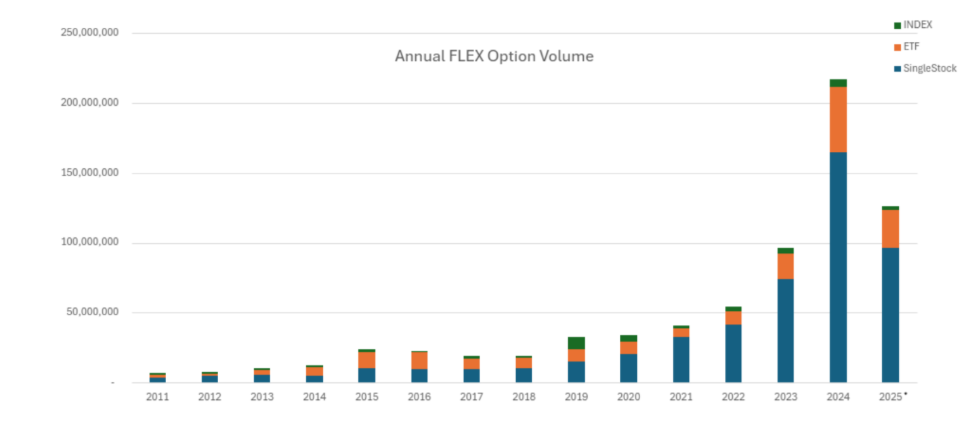

FLEX activity has also been growing, buoyed by demand for exchange-traded funds (ETFs) using derivatives. Average daily volume across single stock, index and ETF FLEX options is up 41% in the year to June 16, compared to the same period in 2024, at 1.2 million (see chart 1).

“Right now we are seeing a lot of investors utilising the customisation FLEX options offer to fine-tune exposure for products like defined outcome ETFs, but they also typically use positions in the lit market as a hedge,” Dugan added. “Before this order type was introduced that was submitted through two or more separate orders, so while this now allows that to be submitted as one order it also means Cboe can streamline risk controls and systems for processing that transaction.”

Chart 1

Source: Cboe

Defined outcome funds use FLEX options to customise exposure – allowing them to set specific downside buffers or upside caps. Traders looking to arbitrage pricing in puts and calls have also been attracted to European style “reverse/conversion” strategies due to interest rate rises, Cboe said in commentary published on Wednesday.